PRESS COVERAGE AND CURRENT EVENTS

The latest in relevance generation and revolution for our clients, their communities, and our industry...

FRAGILE MONEY FACTORIES AND OUR DIGITAL DECENTRALIZATION MOMENT

Bridging community banking and the decentralized, digital future of money

April 28, 2023

What can your institution do in 2023 (and 2024) to prepare for a world which rapidly advances beyond the present day-to-day speed of money? How can community financial institutions start building products and services to meet consumer expectations that money moves at the speed of the internet?

FRAGILE MONEY FACTORIES AND OUR DIGITAL DECENTRALIZATION MOMENT

Is Your Credit Union Evolving as Rapidly as Your Members?

April 17, 2023

Similar to how technology has evolved since the 1990s, consumers' relationship with money has transformed and CUs must adapt. What is a credit union’s unique meaning beyond the transactions of banking? What values has your institution instilled in the community? How will you maintain those values and deepen trust in the era of decentralized finance?

For just a moment, let’s travel back in time to arguably the best decade of movies, TV and music.

Local Value and Private Wealth: How Big Banks and Big Tech Are Bolstering “Credit Union” Strategy

October 14, 2022

DaLand CIO, Jon Ungerland, guest editorial for Finopotamus. Recent events at PayPal, BNY Mellon, and JP Morgan/Ye (Kanye West) can illuminate our thinking about the future value propositions and language that might keep the cooperative community financial services industry relevant....

EMBRACING THE EVOLVING ECOSPHERES OF ENGAGEMENT

October 10, 2022

The streaming money phenomena – the rapidly materializing merger of money with the internet – and digital evolution of community, demand that credit unions extend their value to create diverse, equitable and inclusive ecospheres of engagement.

FRAGILE MONEY FACTORIES AND OUR DIGITAL DECENTRALIZATION MOMENT

August 2, 2022

DaLand CIO, Jon Ungerland, guest editorial for Finopotamus. It’s time to modernize your plant operation in preparation for an era of streaming internet money...

CONTROLLING DATA AT THE 'CORE' OF YOUR CREDIT UNION'S STRATEGY

July 18, 2022

Data has always been an important asset, but today, it’s indispensable. Understanding new consumer attitudes and behavior, and controlling the use of that data – the psychographic insights currently spread across your many systems and platforms – is the key to anchoring your operation as the nexus of community commerce. Your institution, and the communities you serve, will thrive if controlling data is the core of your strategy.

THE DOLLAR COLLAPSE, THE ‘CRYPTO CRISIS,’ AND A GENERATION’S CALL TO GREATNESS

June 17, 2022

A must read. Jon Ungerland, DaLand CIO, pens this important and insightful article. Will we continue to repeat history or change the narrative in present day given the data, tools, and technologies at our disposal?

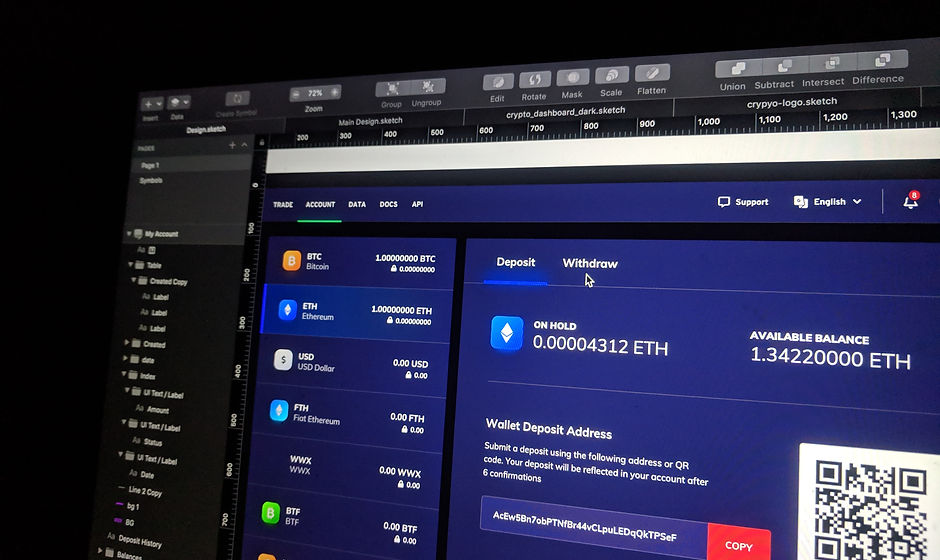

THIS WEEK IN CRYPTO

June 17, 2022

DaLand Chief Information & Innovation Officer, Jon Ungerland, guest editorial for Finopotamus reporting on news and data analysis in the digital currency market.

OBSERVATIONS FROM THE MOST EXCITING COMMUNITY FINANCIAL SERVICES CONFERENCE OF 2022

April 19, 2022

In case you missed out on the most exciting community financial services conference of 2022...Guest Conference Coverage by Jon Ungerland, CIO, DaLand CUSO

SIU CREDIT UNION LEVERAGES DALAND CUSO’S PARTNERSHIP AND PRODUCTS TO GO BEYOND LEGACY BANKING.

March 31, 2022

By transforming its operation to support this strategy and implementing DaLand’s C.O.D.E. Engine, SIU CU is investing directly in communities where it can reach underserved consumers, bridging the divide between physical, electronic and digital community. Crossing this bridge into digital community ensures Southern Illinois’ consumers will have at their fingertips a digital ecosphere committed to local economic health....

LEVERAGING THE DIGITAL DIVERGENCE OF COMMUNITY

March 21, 2022

DaLand's Director of Communication, Jessica Fongemie talks about the importance of CU's expanding connection to digital community, rather than relegating to legacy strategies and priorities.

DIGITAL DISRUPTION OF THE GLOBAL PETRODOLLAR, AND POTENTIAL RENAISSANCE FOR LOCAL INSTITUTIONS

March 25, 2022

DaLand CIO, Jon Ungerland's guest editorial for Finopotamus focused on the essential role local institutions have to contribute to the renaissance of community commerce and complimentary local, digital, democratically controlled, decentralized means of money storage and movement.

TECH CUSO CIO SEES CRYPTO PREDICTIONS COME TRUE

February 24, 2022

Finopotamus talks with Jon Ungerland, CIO at DaLand CUSO and creator of Coin2Core, to get his thoughts on the state of credit union crypto.

IS YOUR CREDIT UNION READY FOR “T” TIME?

June 24, 2021

DaLand's Chief Information & Innovation Officer, Jon Ungerland, gives a quick crash course on ‘generation T,’ or ‘T timers’...

TESLA & DECENTRALIZED VALUE CREATION

April 26, 2021

On a seemingly mundane Monday morning in February a couple billion dollars evaporated from the banking system. That otherwise mundane day featured Tesla’s announcement that they had filed with the SEC to purchase $1.5B (that’s right billion, with a B) in Bitcoin, as part of a plan to allow consumers to buy Tesla products (cars, etc.) with crypto....

THE STATE OF OUR COMMUNITY CREDIT, AND UNION

November12, 2020

DaLand COO Jon Ungerland discusses ways credit unions can develop and use strategies of centralized data and digital connection to community as a means to perspire together to contribute to unity and financial flourishing in their communities in the wake of the 2020 election.

CORONAVIRUS, COMMUNITY, AND COOPERATIVE CAPITALISM

March 16, 2020

DaLand COO Jon Ungerland explores ways in which recent global and economic events will help ensure 2020 is the year merchants and communities accelerate into the future of payments and away from legacy and cash/paper contaminated banking and settlement services.

REOPENING AMERICA RESPONSIBLY ...

March 1, 2020

... requires revisiting local FI strategies for relevance; and DaLand COO Jon Ungerland discusses simple but distinctive strategies for using data and digital channels from the position of a community FI in pursuit of helping America's hurting businesses and communities.

COOPERATIVE CAPITALISM AS A COMMUNITY-CATALYZING STRATEGY FOR CREDIT UNIONS AFTER ELECTION 2020

February 24, 2020

DaLand COO Jon Ungerland discusses strategies for ensuring your financial institution is a relevant epicenter in your community - strategically and digitally - during and after the 2020 election.

COOKING UP A CORE BUSINESS AND CORE TECHNOLOGY STRATEGY

Jan 3, 2020 (Reprint)

What if your vendor relationships are essentially the same as a pasta dish? Let’s call it “the spaghetti pile of vendors and platforms.” Is the pasta dish of platforms around which your members and employees gather to work each day ‘working’ for you, your credit union, your members, and your core strategy? Is your core strategy supported by solid core technology ingredients? Or, are you just choking down the ingredients contributing to the products/services you’re trying to cook up, year after year?

4-STEP STRATEGY TO ENSURE YOUR INSTITUTION PROFITS IN THE RETAIL APOCALYPSE

December 3, 2019

Retailers (physical retail stores) are struggling. Nevertheless, it seems the trend to ‘reimagine’ the credit union and financial institution ‘branch’ as a “retail experience” is picking up steam.

At DaLand CUSO, we think this makes sense; and we think it’s a promising trend. However, not because it’s what Capital One is doing with the “café” concept.

Here are a few things credit unions could be doing to capitalize on a coming tidal change in community commerce and consumer behavior:

THRIVING THROUGH THE DATA WARS ...

August 23rd, 2019

...and other looming perils by ‘banking’ on a new core strategy.

Imagine a reality where your data – not dollars, gold, or oil – but your personal digital DNA is the most valuable and desired commodity in the world. Now, imagine a global market where your data is sold, traded, analyzed, deployed, and consumed as the catalyst for economic, political, and social power.

COMMUNITIES, CRYPTOCURRENCY, AND CORE RELEVANCE

August 2, 2019

DaLand COO Jon Ungerland explores developing trends and critical concepts for designing your financial institution and business strategy in the era of digital assets and cryptocurrency.

MONEY IS MORPHING ...

June 11, 2019

...7 crypto facts your (institution) needs to know to remain relevant in the era of digital assets and cryptocurrency.

COO Jon Ungerland explores trends which will impact financial institutions' abilities to bridge to the new world of money and consumer value.

A SIMPLE [BUT ELEGANT] STRATEGY FOR ANY INSTITUTION ...

December 5, 2018

...to be the relevant epicenter of their community.

COO Jon Ungerland explores the criticality of blending technology, data, and business strategy to fashion and follow a simple core strategy for continued relevance of your business in the community you serve.

COMMUNITY FINANCIAL INSTITUTIONS AND THE DEATH OF GOOD PIZZA!

April 4th 2016

Whether you realize it or not, your community FI is already in the technology business. You offer all sorts of technology tools – online banking, mobile apps, personal financial management, debit cards, etc. – to help consumers manage their money and interact with your institution. But while you’ve loaded up your retail members with all the conveniences that technology has to offer, many of your business members are struggling to remain relevant in a world dominated by major chains with major technology budgets. In this respect, business members are clearly underserved, and community FIs have done very little to change that, instead taking a “that’s not our problem” approach. But the economic stability of the community is your problem – and your responsibility.

Check our news section on a regular basis to always stay in the loop.